Many families in Florida wonder about the adoption through foster care cost before starting their journey. The good news is that most expenses are covered or significantly reduced through state and federal programs.

At Juliana Gaita, P.A., we help families understand exactly what to expect financially. This guide breaks down every cost, subsidy, and resource available to you.

What Actually Costs Money in Florida Foster Care Adoption

Foster care adoption in Florida stands out as the most affordable adoption pathway because the state covers the majority of expenses. According to the Florida Department of Children and Families, the baseline adoption subsidy reaches approximately $5,000 per year until the child turns 18, which demonstrates the state’s financial commitment to these adoptions. Understanding which costs you’ll actually encounter upfront matters for budgeting purposes.

Home Studies and Initial Assessments

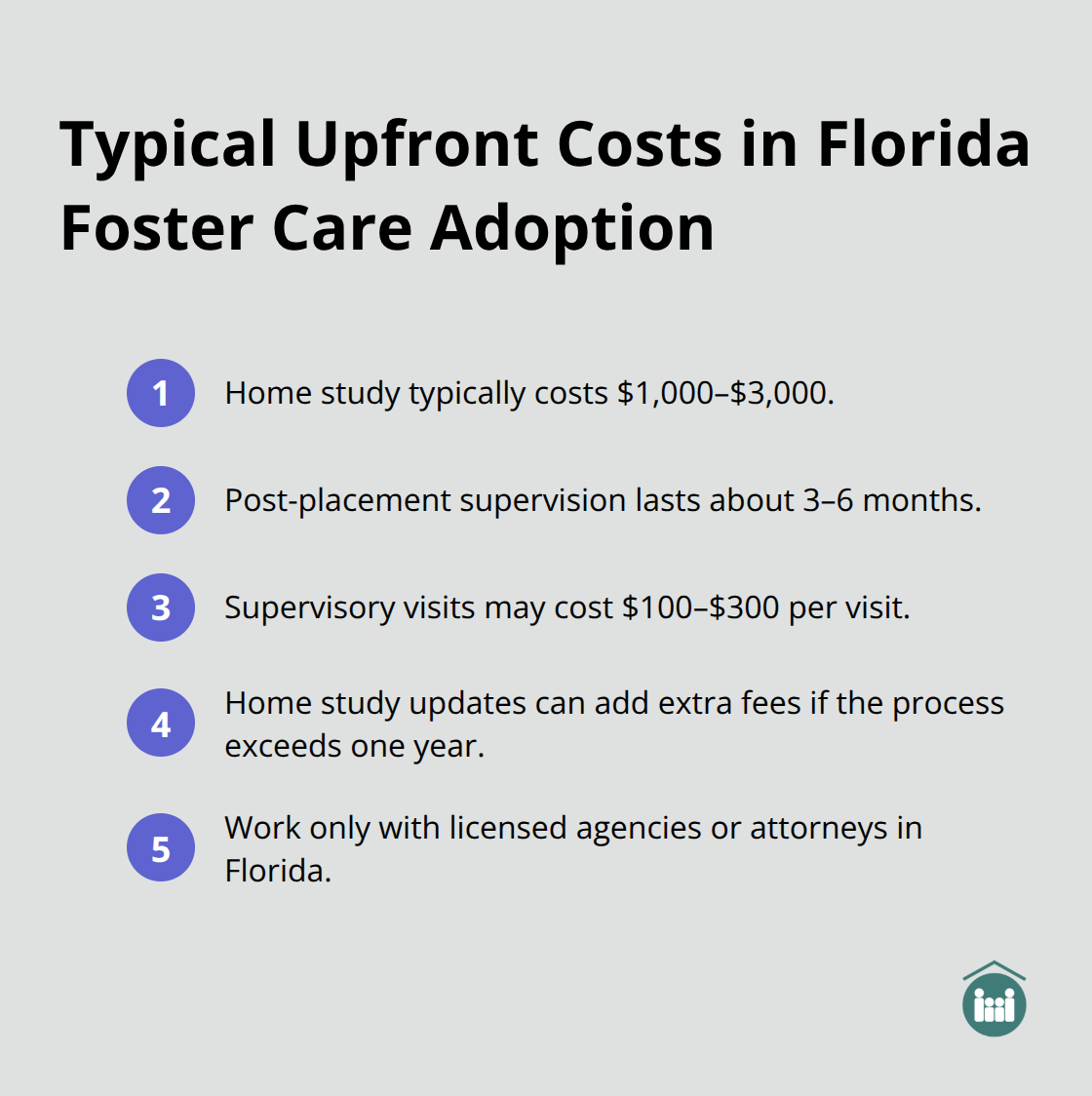

The home study represents your primary out-of-pocket expense and typically ranges from $1,000 to $3,000, depending on the licensed provider you select. This assessment evaluates your home environment, financial stability, and ability to meet a child’s needs. Florida law requires licensed adoption agencies or attorneys to conduct home studies, so working with unlicensed facilitators is illegal. Post-placement supervision fees may apply during the period between placement and finalization, which typically spans 3 to 6 months. These supervisory visits ensure the child’s adjustment and family stability, and some agencies charge $100 to $300 per visit.

Home study updates cost additional fees if your adoption process extends beyond one year, and many families face this reality.

Court and Legal Expenses

Court filing fees and legal expenses form another cost layer, usually totaling $500 to $2,000 for foster care adoptions, though these amounts vary based on case complexity. An adoption attorney helps you identify eligible expenses, maintain legal compliance, prepare documents, and navigate court requirements. These professional services protect your interests throughout the process.

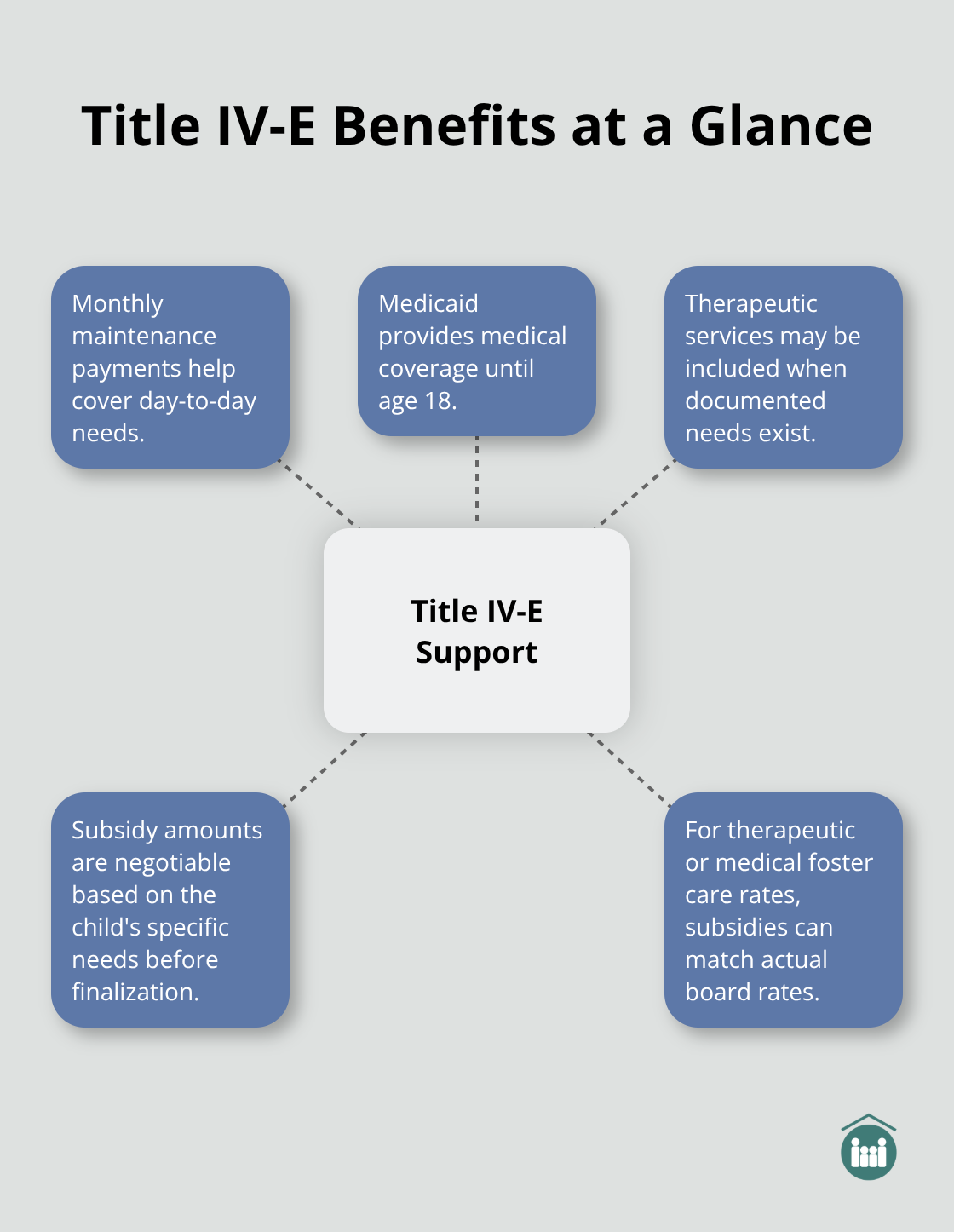

Title IV-E Adoption Assistance Transforms Your Budget

Title IV-E Adoption Assistance provides federally funded support for most children photolisted on AdoptUSKids, meaning the majority of foster care adoptions qualify automatically. This program eliminates the financial burden that makes private domestic adoption cost $15,000 to $40,000 or international adoption exceed $30,000. The federal government covers ongoing support through monthly maintenance payments, medical assistance via Medicaid, and in some cases, therapeutic services.

You can negotiate adoption subsidy amounts based on the child’s specific needs before finalization, and families caring for children with therapeutic or medical foster care rates can negotiate subsidies up to those actual board rates. Medicaid coverage eliminates medical costs for adopted children until age 18, reducing long-term expenses significantly compared to private adoptions where healthcare costs accumulate rapidly.

Additional Support That Reduces Real Costs

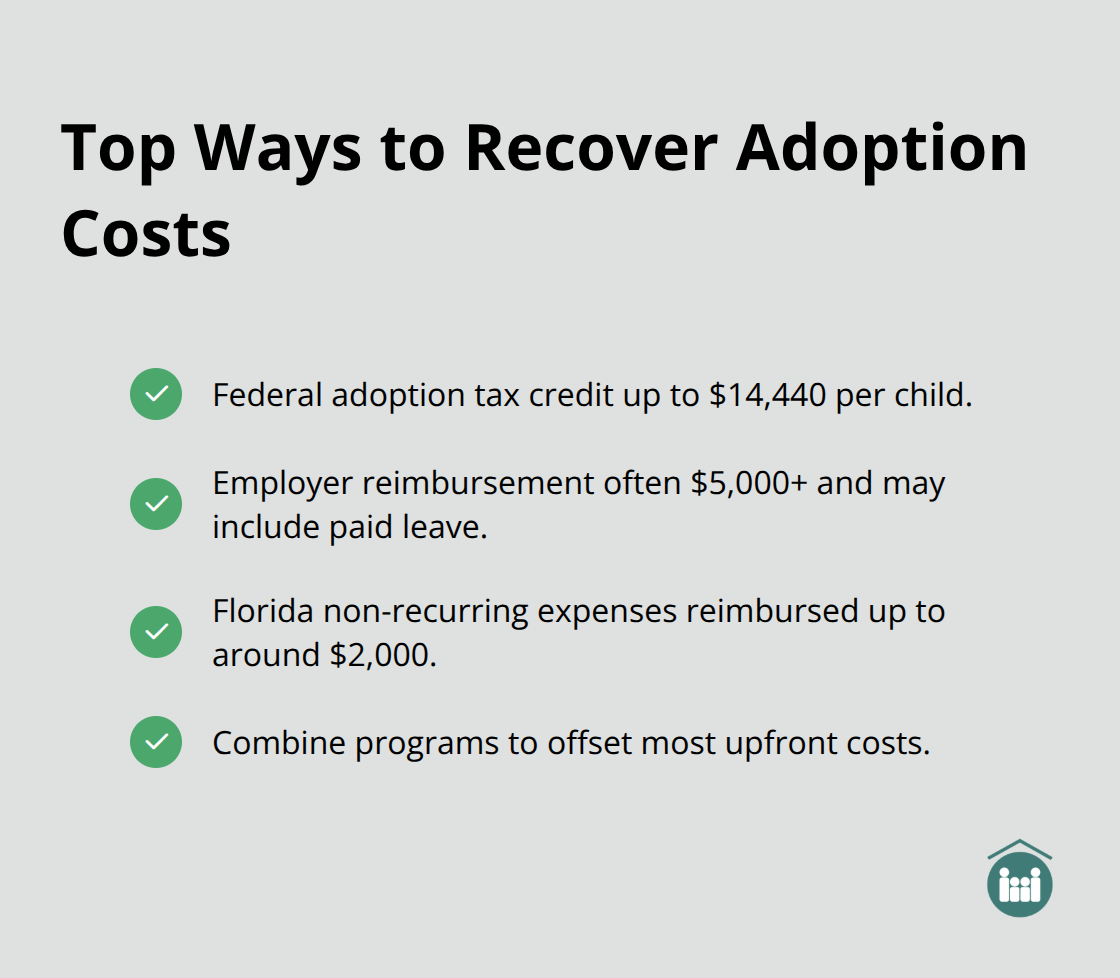

Florida offers tuition waivers at public universities, public community colleges, and public vocational schools for adopted children, covering tuition and fees until age 28. This benefit alone represents substantial savings when considering college costs. Post-adoption services administered through local Community Based Care Agencies include counseling, mental health referrals, and tuition waiver letters at no additional cost. The federal adoption tax credit provides up to $14,440 per child for qualified expenses (verify the current amount with the IRS). Some employers offer adoption benefits including paid leave and reimbursement of adoption costs, so check your human resources department. Non-recurring adoption expense reimbursement programs in Florida can cover certain one-time costs, though amounts vary by circumstance. These layered financial supports mean most families pay minimal upfront costs while receiving substantial long-term assistance.

How to Recover Adoption Costs in Florida

The Federal Adoption Tax Credit

The federal adoption tax credit offers up to $14,440 per child for qualified expenses according to current IRS guidelines. This nonrefundable tax credit applies to legal fees, court costs, home study expenses, and certain agency fees-essentially the out-of-pocket amounts you’ve already paid before finalization. Many families overlook this benefit entirely, which means leaving substantial money on the table. You should verify the current credit amount with the IRS since it adjusts annually for inflation.

Employer Adoption Benefits and Tax Advantages

If your employer offers adoption benefits, that assistance reduces your taxable income further, creating a dual tax advantage that compounds your savings. Some employers provide reimbursement up to $5,000 or more for adoption expenses, plus paid leave during the finalization process. Contact your human resources department immediately to understand what your company covers. The combination of employer reimbursement and the federal tax credit can recover nearly all your upfront costs in many situations.

Florida’s Non-Recurring Expense Reimbursement

Florida’s reimbursement programs specifically target non-recurring adoption expenses, which cover one-time costs like legal fees and court expenses up to around $2,000 depending on your circumstances. These programs exist precisely because the state recognizes that even subsidized adoptions require some initial investment. Post-adoption services through local Community Based Care Agencies help you access tuition waiver documentation and mental health referrals at no cost, reducing expenses you’d otherwise absorb.

Maximizing Your Adoption Subsidy Negotiation

When you negotiate your adoption subsidy before finalization, you can request amounts based on the child’s actual therapeutic or medical foster care board rate if applicable, potentially securing higher ongoing support than the baseline $5,000 annually. This negotiation happens once and locks in your subsidy, so understanding your child’s documented needs before that conversation matters tremendously for your long-term financial planning. The relative and non-relative caregiver benefit program provides Medicaid and monthly financial benefits until age 18 if you meet eligibility requirements, which essentially extends the financial safety net beyond standard adoption subsidies.

Understanding these recovery mechanisms transforms your financial picture significantly. With multiple pathways to offset costs-from federal credits to employer support to state reimbursement-most families find their actual out-of-pocket expenses minimal. The next step involves identifying which specific programs apply to your situation and timing your applications correctly to maximize these benefits.

What Expenses Catch Families Off Guard

Most families focus on subsidies and tax credits but overlook the intermediate costs that surface between placement and finalization. Medical and psychological evaluations for your child happen quickly after placement, often within the first two weeks, and these assessments typically cost $500 to $1,500 depending on the evaluator and complexity of the child’s history. Florida requires these evaluations to establish baseline health status and identify any developmental or emotional needs that affect subsidy negotiation before finalization. Some evaluations qualify for reimbursement under non-recurring expense programs, but you’ll pay upfront and submit receipts later.

Training and Preparation Classes

Florida mandates training and preparation classes before or shortly after placement, with costs ranging from $200 to $800. These classes cover trauma-informed parenting, attachment issues, and behavioral management specific to children from foster care. They directly impact your readiness to handle the child’s actual needs rather than theoretical scenarios.

Specialized Post-Adoption Services

While Florida’s Community Based Care Agencies provide free counseling referrals and tuition waiver assistance, specialized services like therapy sessions for attachment disorders, behavioral coaching, or educational advocacy often require out-of-pocket payment ranging from $75 to $200 per session. The Dave Thomas Foundation for Adoption emphasizes that families should plan for daycare, medical care, mental health services, and education costs extending well beyond finalization.

Travel and Supervision Visit Expenses

Travel expenses for court hearings, home study visits, and placement meetings accumulate quickly, especially if your child’s foster home is distant from your residence. Some agencies charge $100 to $300 for post-placement supervision visits occurring every one to two weeks during the 3 to 6 month period before finalization (these visits ensure the child’s adjustment and family stability). Anticipating these intermediate costs prevents financial surprises and allows you to budget realistically for the true investment in your child’s transition into your family.

Final Thoughts

Foster care adoption in Florida costs significantly less than private domestic or international adoption because state and federal programs shoulder most expenses. Your actual out-of-pocket costs typically range from $1,000 to $5,000 for home studies, court fees, and initial assessments, with many families paying even less when they access available reimbursement programs. The adoption through foster care cost picture improves dramatically when you factor in Title IV-E Adoption Assistance, which provides monthly maintenance payments and Medicaid coverage until your child turns 18.

Multiple financial resources work together to offset your expenses. The federal adoption tax credit covers up to $14,440 per child for qualified expenses, employer adoption benefits can reimburse thousands of dollars, and Florida’s non-recurring expense reimbursement programs recover one-time costs. Post-adoption services through Community Based Care Agencies provide free counseling referrals and tuition waiver assistance, eliminating expenses you’d otherwise absorb independently. When you combine these resources strategically, most families recover their entire upfront investment through tax credits and reimbursement alone.

Contact a legal professional who understands Florida adoption law and can guide you through cost negotiation and financial planning. We at Juliana Gaita, P.A. help families navigate adoption cases throughout Florida and discuss your rights and options with proper legal guidance. Whether you’re ready to move forward or still exploring your options, having experienced legal support ensures you understand every financial aspect before committing to your adoption journey.