Adopting a child in Florida comes with real financial benefits that many families overlook. The adoption tax credit for 2025 and foster care benefits can significantly reduce your out-of-pocket costs.

At Juliana Gaita, P.A., we help families understand exactly what they qualify for and how to claim these benefits on their tax returns. This guide walks you through the numbers, requirements, and strategies to maximize your support.

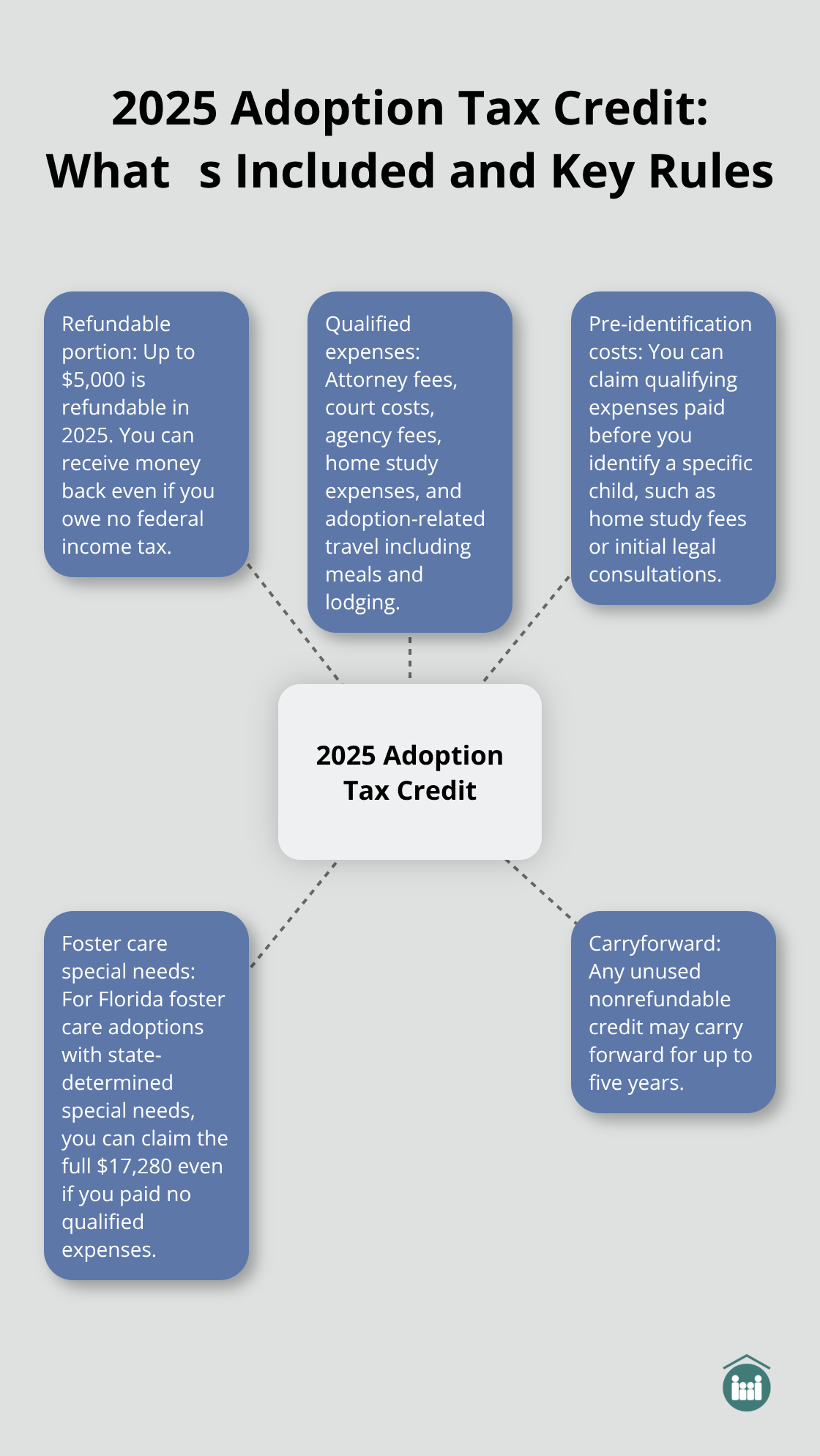

What the 2025 Adoption Tax Credit Actually Covers

The 2025 adoption tax credit offers up to $17,280 per child you adopt. This year marks a significant change: up to $5,000 of that credit is now refundable, meaning you can receive cash back even if you owe zero federal income tax. This refundable portion is new for 2025 and fundamentally changes the benefit for families with lower tax liability. The credit covers attorney fees, court costs, agency fees, home study expenses, and travel related to the adoption (including meals and lodging while away from home).

You can claim expenses paid before you identify a specific child, such as home study fees or initial legal consultations. If you adopt through Florida’s foster care system, the rules shift significantly: you can claim the full $17,280 credit even if you paid zero qualified expenses, as long as the child qualifies as having special needs under state determination. This matters because foster care adoptions often have lower upfront costs than private domestic or international adoptions, yet you still access the full credit amount.

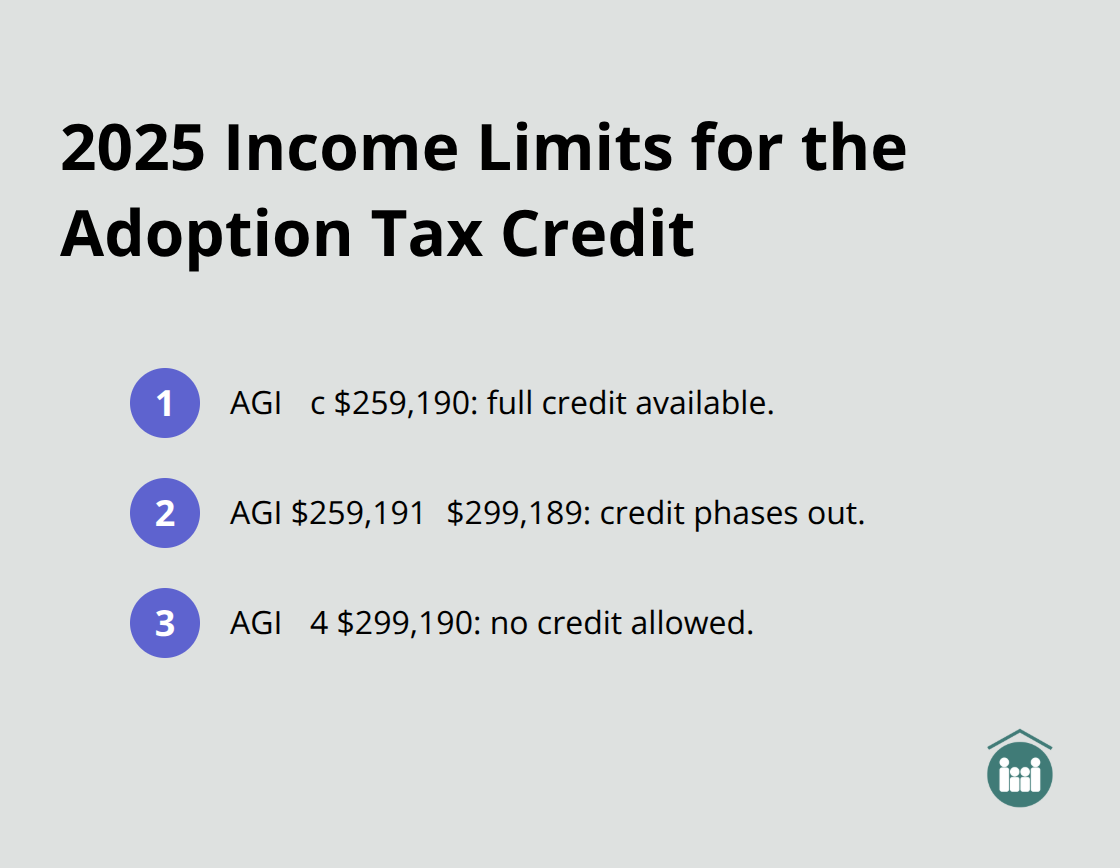

Income determines what you actually receive

Your adjusted gross income directly affects how much credit you can claim. For 2025, if your AGI is $259,190 or less, you qualify for the full credit with no reduction. If your AGI falls between $259,191 and $299,189, your credit phases out gradually. Above $299,190, you cannot claim the credit at all.

This income limit applies per household, not per child, so if you adopt multiple children, the same income threshold applies to your entire family’s return. Married couples filing jointly receive better treatment here-if you are married, filing jointly is generally required to claim the credit. The refundable portion works differently than the nonrefundable portion: any nonrefundable credit you do not use carries forward for up to five years, but the refundable $5,000 portion only applies for the current year. This distinction matters significantly when you plan which year to finalize an adoption for maximum tax benefit.

Timing is everything for maximizing your benefit

The adoption must finalize in 2025 to claim the credit on your 2025 tax return filed in 2026. This is not when you paid expenses-it is when the adoption became final. If your adoption finalizes in early 2026, you claim the credit on your 2026 return, not your 2025 return. Court dockets in Florida fill months in advance, so you should plan your finalization date with tax strategy in mind. If you are close to the income phaseout range, finalizing in the year when your income is lower could preserve more of your credit. Coordinate with your adoption attorney about timing, since rushing to finalize in December might work against you if court availability is tight, and missing the calendar year deadline costs you that year’s benefit entirely.

Special needs adoptions from foster care offer full credit without expenses

Foster care adoptions qualify for special treatment under the tax code. You claim the full credit amount even if the state determined the child has special needs and you paid no qualified expenses. This rule applies specifically to children adopted through Florida’s public foster care system who meet the state’s special needs criteria. The credit amount remains $17,280 per child, and the $5,000 refundable portion applies the same way as other adoptions. This provision recognizes that foster care adoptions serve a public purpose and removes the financial barrier that might otherwise prevent families from adopting children in state care.

Understanding these credit rules sets the foundation for claiming your benefits correctly. The next section walks you through the specific documentation you need to gather and the timeline for claiming these credits on your return.

What Documentation and Timing Actually Matter

Organize receipts and records by expense type

The IRS requires Form 8839 to calculate your credit, and you must support every expense you list. Collect receipts for attorney fees, court costs, agency fees, and home study expenses. Travel expenses require documentation too-keep credit card statements, hotel receipts, and meal receipts for any trips directly related to the adoption process. If you paid expenses before identifying a specific child, such as home study fees or initial legal consultations, document when you paid them and what they covered. The IRS distinguishes between expenses paid before finalization and expenses paid after, so organize documents by payment date.

Handle employer reimbursements correctly

If your employer offered adoption assistance benefits and reimbursed some expenses, keep those records separate-you cannot claim the same expense twice for both the exclusion and the credit. Form W-2 Box 12 Code T shows employer reimbursements, and you must subtract that amount from your total eligible expenses before calculating the credit. This prevents double-dipping and ensures your claim stays within IRS rules.

Document special needs status for foster care adoptions

For foster care adoptions, you still need documentation proving the child qualifies as special needs under Florida’s determination, even though you can claim the full credit without expenses. Contact the Florida Department of Children and Families or your adoption worker to obtain written confirmation of special needs status if you do not already have it. This single document protects you if the IRS questions your claim.

Finalization date controls which tax year applies

If your adoption finalizes on December 15, 2025, you claim the credit on your 2025 return filed in 2026. If finalization slips to January 10, 2026, the entire credit moves to your 2026 return-you lose the 2025 benefit entirely. Florida court dockets fill six to nine months in advance, so do not wait until October to schedule finalization if you want to claim the 2025 credit. Coordinate with your adoption attorney immediately about available court dates and whether finalizing before year-end aligns with your tax situation.

Align finalization timing with your income and tax strategy

If your income is trending lower in 2025 than 2026, finalize in 2025 to maximize the refundable portion and avoid the income phaseout range. The $5,000 refundable portion only applies in the year of finalization, so if you finalize in 2026, you lose that refundable benefit for 2025. Expenses paid in one year but claimed in another year of finalization can create confusion-the IRS allows you to claim expenses in the year finalization occurs, not necessarily when you paid them. This flexibility means you can accumulate expenses across multiple years and claim them all when finalization happens. Your adoption attorney can help you evaluate whether your specific situation benefits from finalizing sooner or waiting until the following year, ensuring you capture every dollar available.

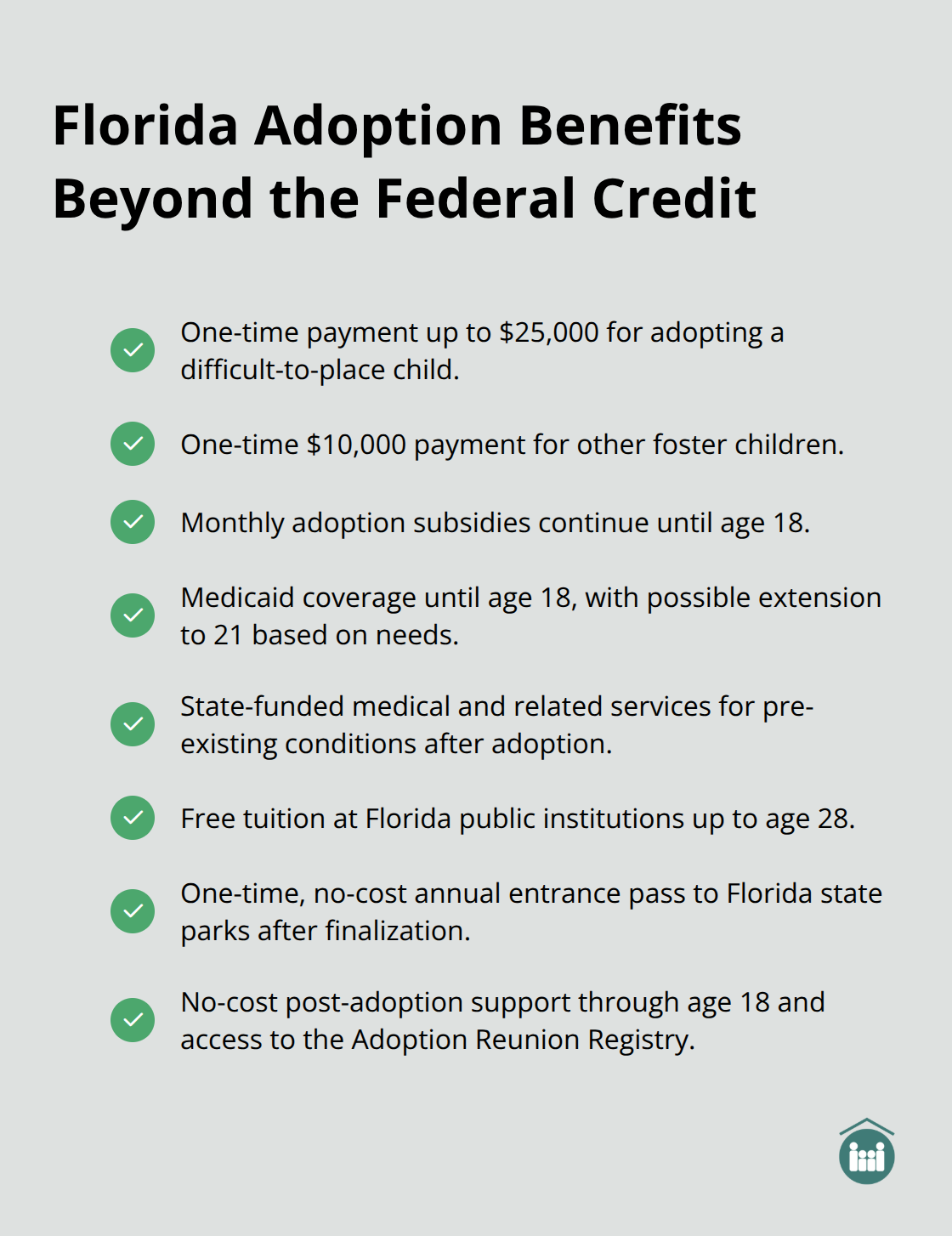

Florida Adoption Benefits Beyond the Tax Credit

Florida’s state programs stack on top of the federal adoption tax credit, creating a comprehensive financial safety net that many families never fully explore. The state offers monthly adoption subsidies, educational benefits, health coverage, and one-time lump sum payments that can total thousands of dollars over your child’s lifetime. If you adopt a child from Florida’s foster care system, you qualify for these state benefits automatically upon finalization, but the amounts and eligibility rules vary significantly based on the child’s age, needs, and background.

One-Time Payments and Monthly Subsidies

The State Employee and Other Qualified Applicants program provides up to $25,000 as a one-time payment for adopting a difficult-to-place child and $10,000 for other foster children. This payment covers non-recurring adoption expenses like legal fees and court costs and arrives after finalization without reducing your federal tax credit eligibility. Monthly adoption assistance subsidies continue until your child turns 18 and vary based on the child’s specific needs and available state funding, according to NACAC’s Florida Subsidy Profile. Children adopted at or after age 16 who spent time in licensed foster care may qualify for monthly stipends while pursuing higher education, extending financial support beyond the typical 18-year cutoff.

Health Coverage and Medical Support

All children receiving monthly subsidies automatically qualify for Medicaid coverage until age 18, with some potentially extending to age 21 depending on documented needs. The state also funds medical, surgical, hospital, and related services after adoption for pre-existing conditions that Medicaid or other programs do not cover, which proves invaluable for children with special needs or complex medical histories.

Educational Benefits and Recreation Access

Florida removes educational barriers through free tuition for adopted foster children at state universities, community colleges, and vocational schools up to age 28 (some private Florida institutions participate in this benefit as well). This single benefit can save $80,000 to $200,000 over a child’s educational lifetime depending on the institution and program length. Upon finalization, adoptive families receive a one-time, no-cost annual entrance pass to all Florida state parks, a practical benefit for families seeking affordable recreation.

Post-Adoption Support and Reunion Services

Post-adoption support services cost nothing and remain available until your child turns 18, including the Post Adoption Communication Program which includes a one-year post-finalization contact to assess your family’s needs. The Florida Adoption Reunion Registry helps adopted adults, birth relatives, and other birth family members connect and provides non-identifying medical or social history information when requested. For eligibility details on these state programs, contact the Florida HR office or the Adoption Information Center at 1-800-962-3678. Coordinating state benefits with federal tax credits requires careful planning around finalization dates and income thresholds, which is where legal guidance becomes essential to avoid costly mistakes.

Final Thoughts

The adoption tax credit for 2025 and Florida’s foster care benefits represent real money in your pocket, but only if you claim them correctly. The federal credit reaches $17,280 per child, with $5,000 now refundable, while state programs add monthly subsidies, educational benefits, and health coverage that extend well beyond finalization. Timing matters more than most families realize-finalizing in the right calendar year and coordinating with your income level can mean the difference between capturing the full benefit or losing thousands of dollars to income phaseouts or missed deadlines.

The adoption tax credit 2025 foster care rules favor families adopting from Florida’s public system, allowing you to claim the full credit even without qualified expenses if the child meets special needs criteria. Stacking federal credits with state benefits creates a comprehensive financial foundation that makes adoption more affordable than many families assume. Court dockets fill months in advance, so waiting until fall to plan your finalization date risks missing the calendar year deadline entirely.

Start by gathering your adoption documentation now-receipts, court records, and proof of special needs status if applicable. Calculate your adjusted gross income against the 2025 phaseout range to understand exactly what you qualify for. Contact us to discuss your specific situation and ensure you claim every benefit available to your family, or visit our office online to schedule a consultation with our adoption attorneys serving Boca Raton and throughout South Florida.